Your tax information on file with the IRS isn’t allowed to be shared with others without permission. There are times you might want someone else to be able to see your current or previous tax returns, such as when an attorney or CPA is helping you out with an IRS issue. That’s where IRS Form 8821 comes in.

You’ll need to submit IRS Form 8821 to authorize another individual or business to receive and inspect your personal tax information.

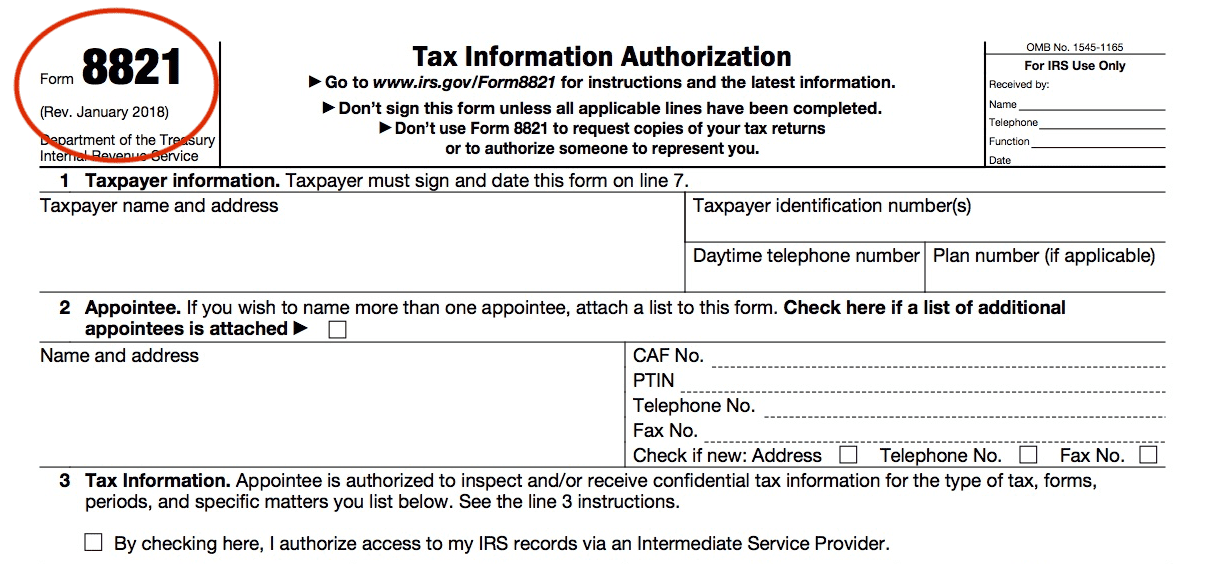

What Is Form 8821?

IRS Form 8821 is a single-page form that allows any taxpayer to designate another person or company to receive their confidential tax information from the IRS.

When Do I Need to File Form 8821?

You must file Form 8821 before the IRS will release your tax information to any party other than yourself. For example, you’ll want to submit Form 8821 when an attorney is helping you with an IRS audit or a tax expert is helping you apply for IRS tax debt relief.

If you are granting permission for any reason not involving an active tax issue with the IRS, the time limit for the IRS to receive Form 8821 is 120 days after all relevant parties have signed and dated it.

If you are granting permission because the other party is helping you with an active IRS issue, such as an audit, then the 120-day time limit does not apply.

Where Do I File?

Once you have completed IRS Form 8821 and all applicable parties have signed it, you have three options for how to file it with the IRS. You can send it via fax or mail, or you can file it online.

File by Fax or Mail

To file Form 8821 by fax or mail, send it to the fax number or mailing address designated for your state or location, which you can locate in the table below. This information is up to date as of June 2022.

Here’s where to mail or fax your 8821 if you live in:

AL, AR, CT, DC, DE, FL, GA, IL, IN, KY, LA, MA, MD, ME, MI, MS, NC, NH, NJ, NY, OH, PA, RI, SC, TN, VA, VT, WV

Form 8821 Mailing Address 1:

Internal Revenue Service

5333 Getwell Road, Stop 8423

Memphis, TN 38118

Form 8821 Fax Number 1:

855-214-7519

AK, AS, CA, CO, HI, ID, IA, KS, MN, MO, MT, NE, NV, NM, ND, OK, OR, SD, TX, UT, WA, WI, WY

Form 8821 Mailing Address 2:

Internal Revenue Service

1973 Rulon White Blvd., MS 6737

Ogden, UT 84201

Form 8821 Fax Number 2:

855-214-7522

APO and FPO addresses, American Samoa, Commonwealth of the Northern Mariana Islands, Guam, U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States

Form 8821 Mailing Address 3:

Internal Revenue Service

International CAF Team

2970 Market Street

MS 4-H14.123

Philadelphia, PA 19104

Form 8821 Fax Number 3:

855-772-3156 (From inside US)

304-707-9785 (From outside US)

File Online

A tax professional can also submit your Form 8821 online. Don’t worry – Wiztax can help!

Form 8821 Instructions for Tax Information Authorization

IRS Form 8821 has six key sections that must be filled out accurately and completely to authorize someone else to be able to receive your tax information.

- Section 1 requires your taxpayer information and has different prompts depending on whether you’re an individual filer or a business.

- Section 2 asks for the information of the person or business to whom you wish to grant permission to receive your tax information.

- Section 3 is where you specify the tax information and years you are granting them permission to view.

- Section 4 allows you to grant permission for another party to view information not recorded on the Central Authorization File (CAF) system.

- Section 5 is for retaining or revoking permission you’ve previously granted.

- Section 6 is where signatures are required.

What’s the Difference Between Form 8821 and Form 2848 (Power of Attorney)?

IRS Form 2848 allows you to grant power of attorney (POA) to another person to represent you before the IRS. This means the person can actually make decisions and execute IRS agreements on your behalf. Form 8821, by contrast, only gives the designated party permission to view your confidential tax information.

How Can Wiztax Help?

Schedule a free phone consultation so we can learn a bit more about your situation, and we will tell you exactly how we can help. We never charge for consultations or ‘investigations’.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.