IRS collections can be a worrisome process since most people have no idea what to expect. For those who owe back taxes, it is likely the IRS will start collections when they don’t receive a tax payment or request for payment arrangements.

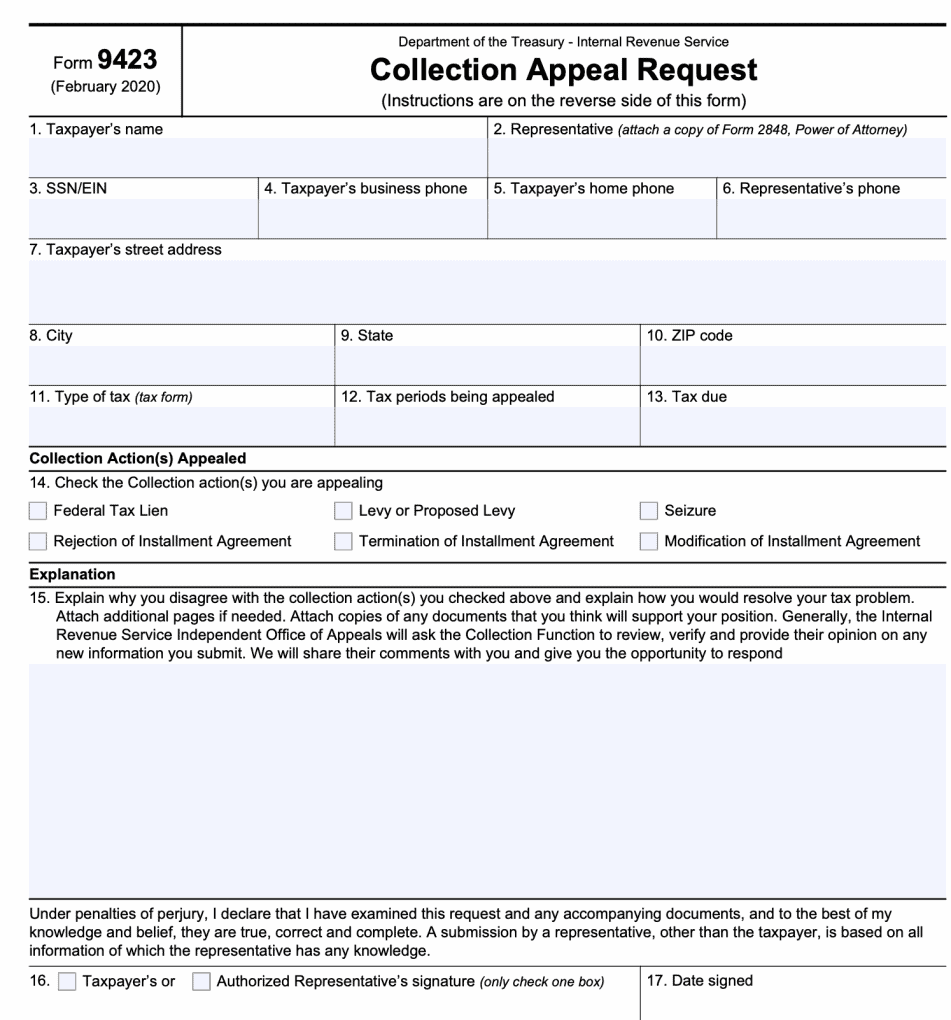

In some cases, a taxpayer will want to appeal IRS collections to change or stop enforcement actions against them for nonpayment. IRS Form 9423 is used to request an appeal when the IRS starts collections.

When Do You Use IRS Form 9423?

Taxpayers use Form 9423 when they have a tax debt and want to appeal IRS collections, like tax liens being issued, paycheck wages being garnished, and bank accounts being levied. If an individual already has a payment plan with the IRS and the IRS terminates that agreement early, Form 9423 can also be used to appeal the IRS decision.

What IRS Collections Actions Can You Appeal with Form 9423?

You can appeal a wide range of IRS collection activities using this form. This includes:

- Federal tax liens

- Levies or proposed levies

- Property seizures

- Rejection, termination, or modification of an IRS payment plan/installment agreement

How Do You Fill Out Form 9423?

Form 9423 will ask for your personal information (name, address, SSN, etc.), specific collection actions you want to appeal, an explanation of why you disagree with the IRS actions, and how you plan to resolve your back taxes. You must also include documents as evidence that supports your case.

Where Do You Mail or Send Form 9423?

If you are appealing a federal tax lien, IRS levy, or property seizure, you’ll send your 9423 to whichever office initiated the collection action. If you are appealing an IRS installment agreement decision, you will send your form to the office that either rejected, terminated, or modified your agreement.

Will the IRS Stop Collections When You Appeal?

When you file a 9423 form, you’re taking the first step. This means that the IRS is likely to stop all collection activity until they review your appeal request. It does not mean you never have to pay the tax debt, though. IRS collections actions will remain until your case is settled.

During the time that the appeal is being considered, however, the IRS is unlikely to take further actions to collect on that debt.

What Is the IRS Collection Appeals Program (CAP)?

The Collection Appeals Program (CAP) is designed to provide taxpayers with a way to challenge an IRS decision regarding tax collection. This program enables taxpayers, or those who represent taxpayers, to appeal the decisions made against them with respect to levies, liens, installment agreements, seizures, and third-party property claims.

Is CAP the Same as a Collection Due Process (CDP) Hearing?

There are differences between CAP and CDP. You should know the difference if you are heading into tax court. CAP focuses on appealing decisions about the taxes listed above. A Collection Due Process request is different in that it is a hearing that is generally at the end of the tax enforcement matter, such as when an intent to levy or notice of a federal tax lien is placed.

How Long Does the IRS Collection Appeals Process Take?

For many people, time matters, especially as tax debt continues to build with more interest and penalties. The CAP process can take some time to complete. While under review, you do not have to worry about the IRS pursuing the tax debt.

It can take 9 months to a full year for IRS appeals to be heard. Sometimes it can be done faster, but there are limitations in this process, including the burden of proving the debt.

There is also no guarantee that the appeals process will result in a positive outcome for the taxpayer. You may still owe the tax debt in full, though in some cases the result can be a reduction in tax liability.

Need help? You can schedule a free call or start online by answering 6 simple questions. We never charge for ‘investigations’ or consultations.

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.