Set up an IRS installment agreement if you owe the IRS back taxes but cannot afford to pay your balance in a lump sum. An installment agreement is basically an IRS monthly payment plan. The benefit of an installment agreement is that the IRS offers it to everyone. Unlike other IRS Fresh Start Initiative tax relief programs, starting a payment plan does not require proof of financial hardship.

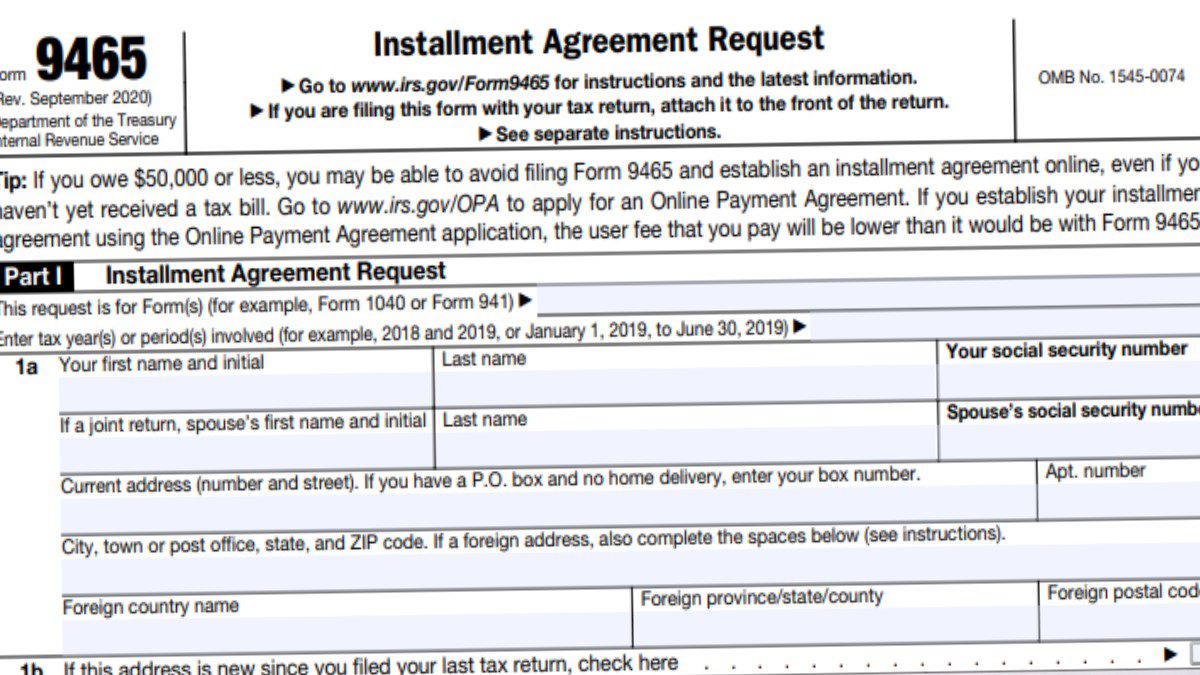

To set up an installment agreement, the IRS requires you to complete IRS Form 9465. Here is what you need to know about Form 9465 and the IRS installment agreement process.

What Is Form 9465?

IRS Form 9465 is an Installment Agreement Request. It allows you to set up a monthly payment plan to pay back the taxes you owe so that you do not have to come up with the money all at once.

The IRS uses the information on Form 9465 to approve your installment agreement and monthly payment amount. IRS 9465 asks for financial information such as the amount you owe in taxes, your annual income, and monthly expenses.

Using your 9465 information, the IRS calculates how much it believes you can reasonably afford to pay each month toward your tax debt. In most cases, the IRS expects you to pay your back taxes in 72 months or less, but it makes exceptions in limited circumstances, such as a high tax balance due combined with a low household income.

When Should I File Form 9465?

You should file Form 9465 as soon as possible if you have a tax debt and cannot pay the full amount you owe the IRS. Keep in mind that interest on unpaid taxes compounds daily.

If you have a financial hardship, you may want to first apply for other tax debt relief programs, such as an Offer in Compromise or Currently Not Collectible status.

An installment agreement is the best “plan B” if you do not qualify for these tax relief programs.

When Should I NOT File Form 9465?

Here are the situations when you should not file Form 9465:

- You can pay your full tax debt, plus penalties and interest, in 120 days or less.

- You owe less than $50,000, haven’t already requested an installment agreement, and you want to apply online using the IRS’s online payment agreement application rather than submitting Form 9465.

- You already have an installment agreement and need to modify it for any reason, including when you have fallen behind on payments. In this situation, you must call the IRS directly at 1-800-829-1040 to make new arrangements.

- You still have a business and owes taxes for employment and/or unemployment.

Where Do I Download Form 9465?

You can download IRS Form 9465 directly from the official IRS website at https://irs.gov/forms-pubs/about-form-9465.

How Do I File Form 9465?

You can file IRS Form 9465 by mail or apply for an installment agreement online. If you owe more than $50,000 in taxes, you must mail Form 9465 to the IRS.

Apply For IRS Installment Agreement Online

You can apply for an IRS installment agreement on the IRS website: https://irs.gov/payments/online-payment-agreement-application. When you apply online, you will receive immediate confirmation for whether your payment plan is approved. The online IRS installment agreement application fee is $31 (direct debit) or $149 (check, money order, debit/credit card).

File Form 9465 by Mail

You can also file IRS Form 9465 by mail. The IRS address you will need to mail your 9465 to depends on your state. You can find a list of addresses by state on the Form 9465 instruction page on the IRS website under the section “Where to File.”

The installment agreement application fee when you mail 9465 is $107 (direct debit) or $225 (check, money order, debit/credit card). There are reduced fees and waivers for low-income taxpayers.

Form 9465 Instructions

Instructions for Form 9465 are fairly simple and straightforward. It features two parts: the installment agreement request itself and a section for additional information.

The installment agreement request asks for basic identification information (e.g., your name, address, SSN, etc.) along with other information about the taxes you owe. The additional information section is where you provide more detailed personal information such as your marital status, household income, number of cars you own, car payment amount, and other monthly expenses.

It is essential to fill out Form 9465 information as accurately as possible. Do not just guess. The IRS may request documentation to support the income and expense amounts you provide, so make sure your documentation is readily available.

If you owe taxes and cannot pay the balance, you should set up an installment agreement as soon as possible. The longer you wait, the more tax you will pay. IRS penalties and interest charges add up quickly and the IRS can levy your wages and bank accounts or file a tax lien.

Need more help or have questions? Call us today at (866) 568-4593 to learn more about how we can help.

Or start here to take our free online evaluation and we will reach out!

6 Simple Questions. Free Evaluation.

Join our Newsletter

Enter your email address to join our free newsletter. Get all the latest news and updates.